Libyan Carbon Credit Industry is Here – What You Need to Know

Earlier this week, Tripoli Public Services Company and Oilinvest finalised an agreement to plant one million trees in Tripoli to generate carbon credits. This initiative complements the Libyan Ministry of Planning’s broader goal to plant 100 million trees by 2030, and parallels the National Oil Corporation’s campaigns in Al-Assa and Al-Jufra.

With Libyan companies like OilInvest targeting net-zero emissions by 2050 and carbon credits increasingly discussed, it prompts the question: Are carbon credits on track to become a significant industry in Libya?

Table of Contents

What is a Carbon Credit?

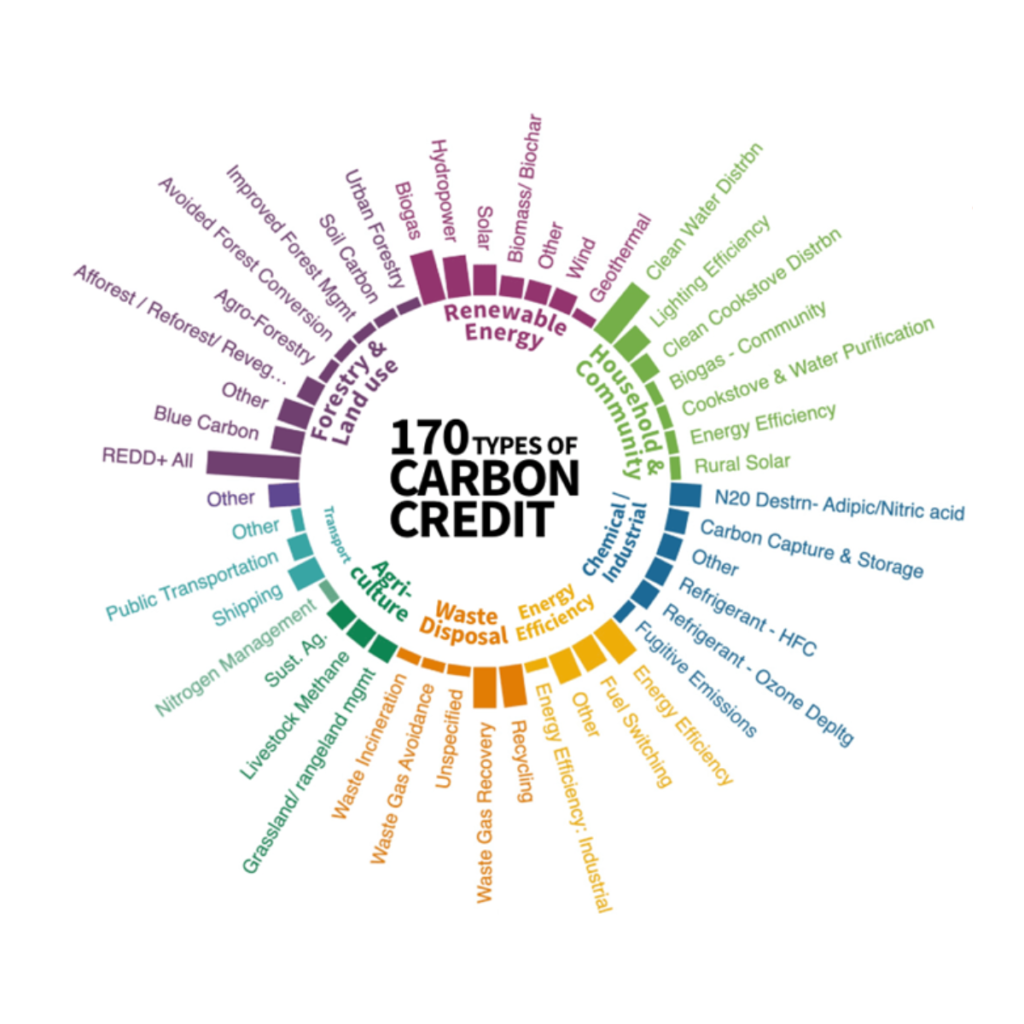

A carbon credit is a certificate or permit which represents the right to emit one ton of carbon dioxide (CO2) or the mass of another greenhouse gas equivalent to one ton of CO2. Carbon credits are generated from projects that reduce, avoid, or capture emissions. These projects can range from renewable energy, energy efficiency upgrades, to forest conservation and afforestation. The main purpose of carbon credits is to incentivize reductions in emissions of greenhouse gases into the atmosphere.

What is the Difference Between Carbon Credits and Carbon Offsets?

While the terms are often used interchangeably, carbon credits and carbon offsets represent distinct mechanisms within climate regulation frameworks. Carbon credits, also known as carbon allowances, serve as permissions that allow entities to emit a specified amount of CO2—typically one ton per credit. These credits are integral to cap-and-trade programs enforced by governments, which impose limits on emissions and mandate reductions over time. In contrast, carbon offsets involve the removal of CO2 from the atmosphere through activities like reforestation and are primarily traded on voluntary carbon markets.

How Does a Cap-and-Trade System Work?

A cap-and-trade system is a market-based approach used to control pollution by providing economic incentives for achieving reductions in the emissions of pollutants. A central authority (usually a governmental body) sets a limit or cap on the amount of a pollutant that can be emitted. Companies or other groups are issued emission permits and are required to hold an equivalent number of allowances (or credits) which represent their right to emit a specific amount. Companies that need to increase their emission allowance must buy credits from those who have excess. Over time, the overall limit on emissions is gradually reduced, thereby lowering the total emissions and encouraging sustainability and innovation in pollution control.

What Benefits Do Carbon Credits Offer to Businesses?

Carbon credits serve as a versatile financial instrument for businesses, facilitating compliance with evolving environmental regulations in a cost-efficient manner. By purchasing them, companies can meet emission targets without immediate capital investment in new technologies or making any change, thus optimizing short-term financial outlays.

Furthermore, businesses that actively reduce emissions can monetize these efforts by generating and selling carbon credits, creating an alternative revenue stream. Engaging in the carbon market not only leverages financial benefits but also enhances a company’s environmental reputation, attracting eco-conscious investors and customers, which in turn strengthens market positioning and potentially increases shareholder value.

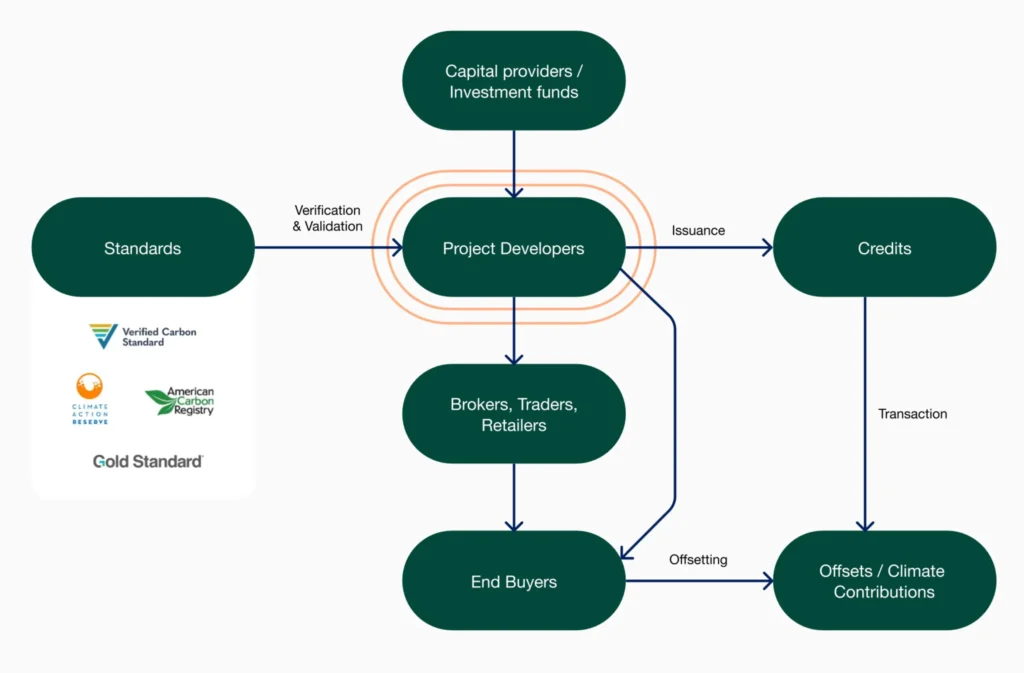

How are Carbon Credits Produced?

Step 1: Project Development and Feasibility Assessment

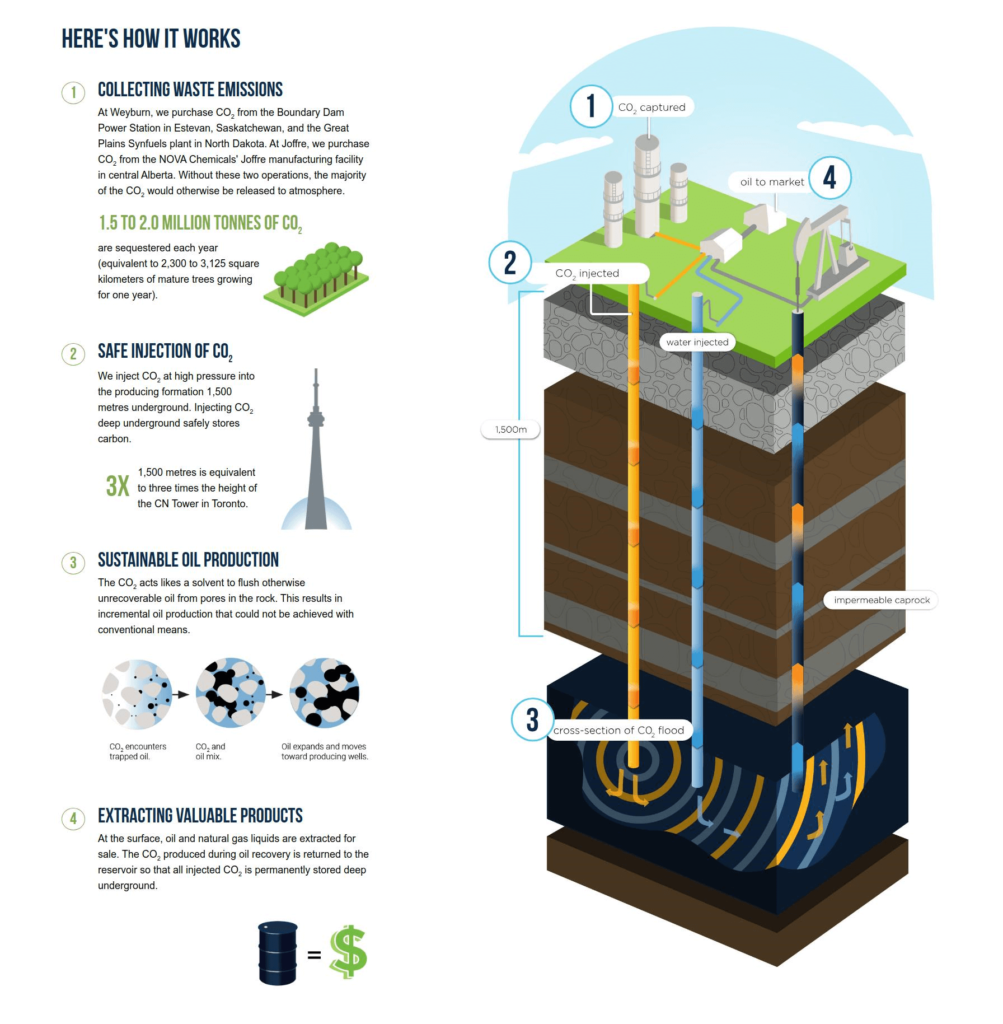

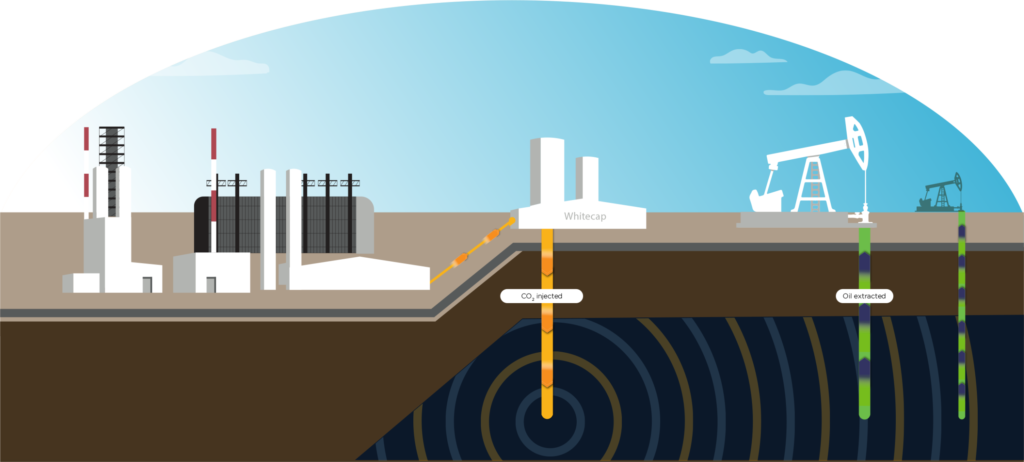

Projects initiate with identifying potential projects based on their ability to significantly reduce or sequester greenhouse gases. For example, Whitecap Resources employs an advanced CO2 sequestration method that injects CO2 into depleted oil fields, which not only securely stores CO2 but also enhances oil recovery—a process known as Enhanced Oil Recovery (EOR). This dual-benefit approach must be evaluated against strict criteria set by standards such as the Verified Carbon Standard (VCS) to ensure it contributes verifiable environmental benefits and aligns with regulatory frameworks for carbon trading.

Step 2: Technical Validation

A detailed technical review and validation by an accredited third party follows feasibility studies. The validator examines the project’s methodology for capturing or reducing emissions, ensuring that it adheres to international standards and methodologies. For sequestration projects like those of Whitecap Resources, the validation process scrutinizes the integrity of geological storage sites to confirm permanent CO2 containment and assesses the monitoring strategies for accuracy and reliability in measuring trapped CO2 volumes.

Step 3: Monitoring, Reporting, and Verification (MRV)

Post-validation, continuous monitoring involves precise data collection regarding the actual amount of CO2 captured or emissions reduced. This step is critical in substantiating the claimed carbon reductions. In the context of Whitecap Resources, this would include monitoring the volumes of CO2 injected, the pressure and integrity of the injection sites, and any potential CO2 leakages. The collected data is then reported and subjected to independent verification to ensure compliance with initial projections and ongoing performance benchmarks. Verification is intended to affirm the project’s impact on reducing atmospheric CO2, underpinning the credibility of the resulting carbon credits.

Step 4: Certification and Issuance of Carbon Credits

Once verified, the project is eligible for certification, wherein verified reductions are formalized into a financial instrument. Representing one tonne of CO2 equivalent either reduced or sequestered, each credit is serialized to assure traceability and authenticity. This serialization maintains market integrity, preventing double counting and ensuring that each credit can be tracked back to its origin. These credits are then listed on carbon markets, where they can be traded. Investors and companies purchase these credits to offset their emissions, contribute to global emission reduction targets, and enhance their corporate sustainability profiles.

What Are the Primary Markets for Carbon Credits?

Traded on two principal platforms, these are: the compliance market and the voluntary market – each serving distinct functions and caters to different participants.

Compliance Market

Under stringent regulatory mandates from national or international environmental authorities, this market functions through cap-and-trade systems. Total allowable emissions are periodically capped and reduced to meet climate goals. Companies in regulated sectors are required to obtain enough credits to cover their emissions, providing an economic incentive to reduce their carbon output. Credits are allocated based on historical emissions or via competitive auctions designed to reflect credit scarcity and elevate prices, thus accelerating emission reductions. For investors, the compliance market offers a predictable, regulation-driven environment essential for long-term asset valuation and risk management in emissions-heavy industries.

Voluntary Market

Conversely, the voluntary market enables companies, governments, and individuals to buy carbon credits at their discretion. This market appeals to those aiming to surpass regulatory mandates, achieve corporate social responsibility objectives, or improve their environmental reputation among eco-conscious consumers. Credits here often back projects that deliver extra environmental or social advantages, like biodiversity conservation, community upliftment, or renewable energy initiatives. Credit pricing in this market varies widely, influenced by the perceived quality and additional benefits of the projects, making it a complex yet potentially lucrative investment arena for those seeking to mitigate environmental risks or invest in burgeoning green technologies.

Libyan Carbon Credit Industry: Future Outlook

While Libya currently focuses on the foundational approach of tree planting for carbon sequestration, the industry is expected to evolve and diversify into several more sophisticated and impactful areas. As the country advances its capabilities in carbon credit generation, we anticipate the following variations to gain prominence:

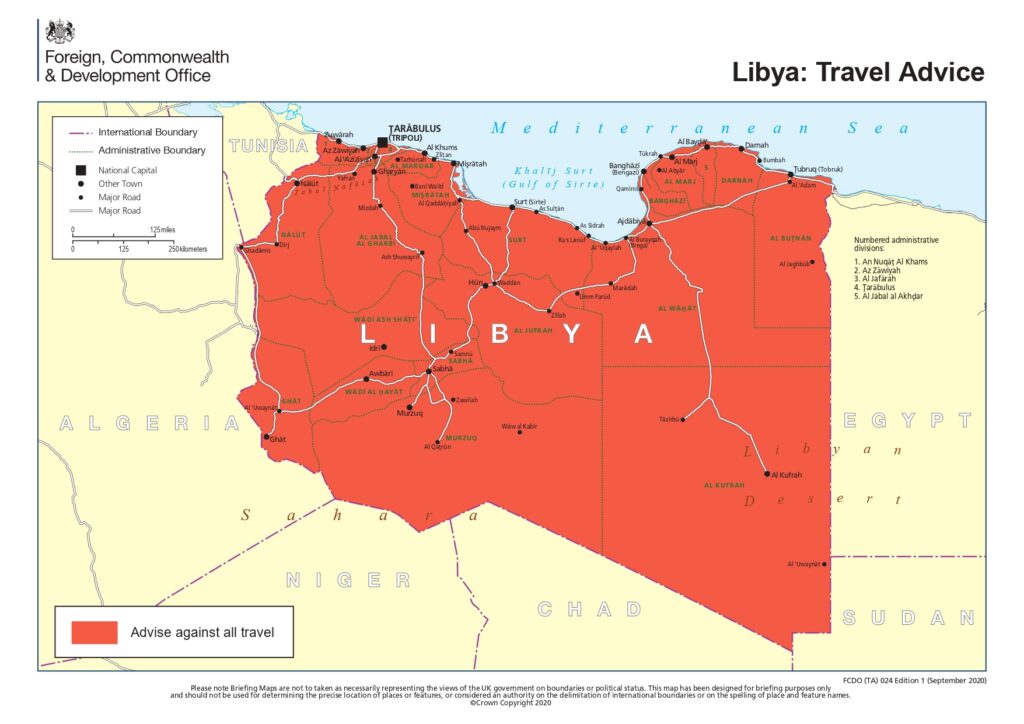

- Natural Reserve Management: Across its vast 1.76 million square kilometers, natural reserve management in Libya offers a significant opportunity for its generation. Drawing inspiration from successful conservation models like African Parks, Libya will surely transform underutilised lands into carbon sequestration natural reserves.

- CO2 Injections: Mimicking WhiteCap Resources’ method, CO2 can be injected deep underground into the producing formation, storing carbon safely. Acting as a solvent, the injected CO2 extracts otherwise unrecoverable oil, leading to increased oil production. Extracted oil and natural gas liquids are sold, while CO2 produced during this process is permanently stored underground — ultimately contributing to the creation of the financial instrument.

- Renewable Electricity Generation: Drawing from methodologies like those employed by the Renewable Energy Authority of Libya, the nation can actualize projects and maximize their value through carbon credit generation. By adhering to established conservation models, Libya can transform its energy landscape, contributing to carbon sequestration and facilitating the creation of the financial instrument.

- Urban Transport of Passangers: Initiatives such as bus rapid transit projects offer significant opportunities, as by modernizing urban transportation infrastructure, Libya can reduce carbon emissions associated with traditional commuting methods, promoting sustainable mobility and accruing carbon credits.

- Treatment of Wastewater: Projects focusing on industrial wastewater treatment in anaerobic digesters, along with utilizing biogas for electricity and heat generation, provide viable pathways for carbon credit generation. Aligned with the National Water and Sanitation Plan, Libya can address wastewater management challenges while leveraging these processes to mitigate carbon emissions and generate valuable carbon credits.

Libya boasts a diverse array of methodologies for generating this financial instrument, spanning from initiatives like the distribution of efficient light bulbs to households. As such, the primary challenge lies not in identifying projects or methodologies but rather in facilitating the trading of these carbon credits in international markets. This necessitates rigorous compliance with international standards for monitoring, reporting, verification, and certification.

Establishing a national institution dedicated to carbon credits could streamline this process and its potential commercialisation, thereby maximizing Libya’s participation in the global carbon market. Drawing from all the above therefore, the question becomes not if, but when this will become a reality in the near future.