Will Oil Prices Hit $150/Barrel by 2024?

By Danilo Morodo Slobodyanyuk

In a rapidly evolving geopolitical landscape, the confluence of politics, economics, and energy dynamics takes center stage. As nations gravitate towards opposing poles, the potency of energy as a strategic asset intensifies. At the heart of this maelstrom lies Russia, adeptly positioning itself to capitalize on this intricate web of interdependencies. Yet, beneath the stratagems and counter-stratagems, a pressing query looms large: Is the world on the precipice of witnessing oil prices skyrocket to $150 per barrel by 2024? This article delves deep, offering a sophisticated analysis rooted in contemporary economic frameworks, with a keen understanding of the nuances inherent in geopolitical maneuvering.

Table of Contents

NATO-Russia: The Evolution of a Complex Relationship

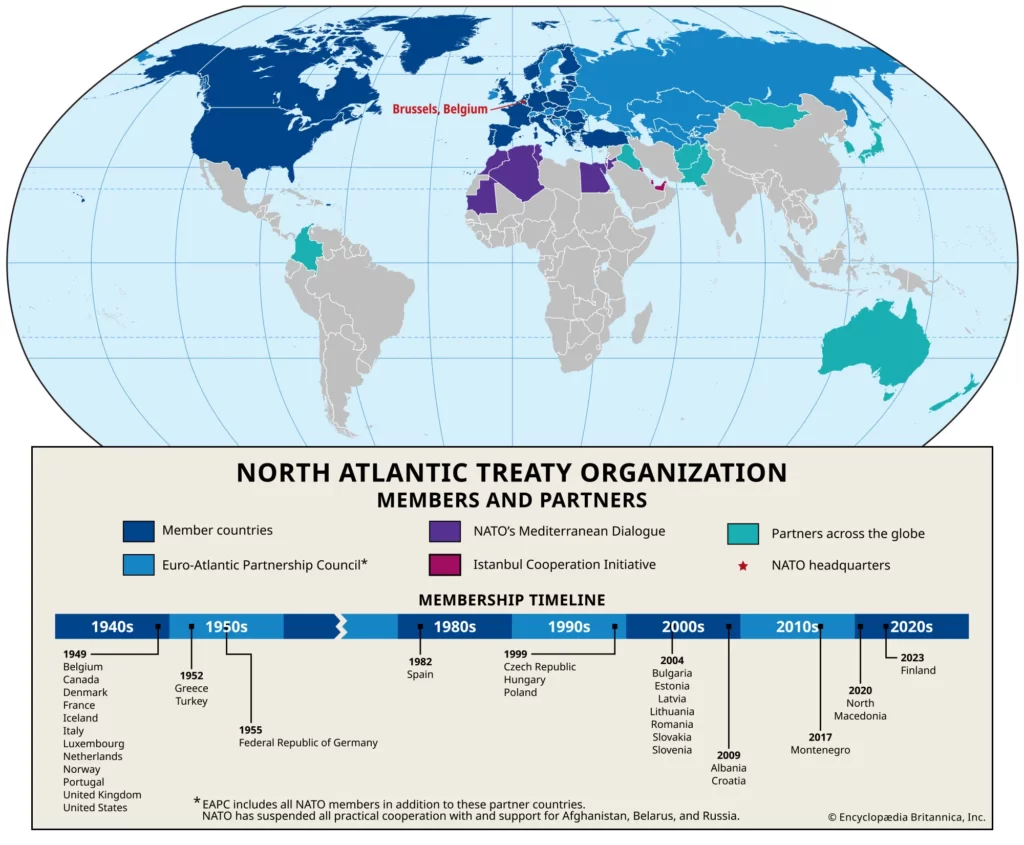

Established in 1949, NATO’s primary raison d’être was to safeguard its member states against potential Soviet encroachment, marking the Soviet Union as its chief adversary. However, the subsequent dissolution of the USSR in 1991 left NATO temporarily without a distinct counterpart. By 1993, the Russian Federation emerged, positioning itself as the successor to the Soviet Union and maintaining its seat on the United Nations Security Council.

During the transition, doubts regarding NATO’s continued relevance surfaced. The once-feared Soviet entity had vanished, diminishing the palpable threat it once posed. Early 2000s discussions about the possibility of Russia’s integration into NATO added to the uncertainty. However, these dialogues remained unrealized, leading to a sharpened dichotomy between NATO, representing the united Western front, and Russia.

The strategic eastward expansion of NATO marked a pivotal turn in the discord. Incorporating nations such as Poland, the Czech Republic, and the Baltic states into the alliance enhanced NATO’s territorial breadth but also invoked Russia’s ire. The new boundaries’ proximity to the former Soviet sphere and Russia itself was perceived as a direct affront. In the wake of such realignment, Russia conveyed stern warnings to the West, cautioning against further NATO encroachment and hinting at decisive counteractions.

Tensions escalated with Russia’s annexation of Crimea in 2014, a peninsula of strategic importance in the Black Sea. Many argue that Russia’s move was a countermeasure to NATO’s alleged intentions of stationing rocket launchers in the region. The bold annexation prompted the West’s first round of sanctions against Russia. Yet, these punitive measures brought little resolution. The climax of NATO-Russia tensions arose with Russia’s ilegal incursion into Ukraine in February 2022. In response, Western countries united, imposing stringent sanctions on Russia and bolstering Ukraine with military support, leading to an intense standoff between the global heavyweights.

The ongoing NATO-Russia conflict underscores the potential implications of Russia’s energy initiatives. Despite past peace attempts between Ukraine and Russia, with intermediaries such as Belarus and figures like Roman Abramovich, peace remains elusive. President Zelenskiy’s stance—that negotiations are untenable while Russian troops occupy Ukrainian soil—hints at a lingering deadlock reminiscent of the North-South Korean peninsula’s dynamics. Russia’s aversion to a prolonged impasse emphasizes the need for genuine diplomacy, requiring understanding of the adversary, a willingness to make concessions, and the establishment of mutually beneficial terms—qualities seemingly absent in current Western tactics. As a result, Russia seeks alternative strategies to combat the pressures from the Western alliance.

Russia’s Strategic Use of Energy Diplomacy

The evolving geopolitical landscape accentuates the strategic importance of Russia’s energy policy, positioning it at the forefront of international scrutiny. Contrary to earlier assumptions that its influence might diminish, there’s a growing consensus suggesting Russia could employ its vast energy reserves as a significant geopolitical lever. Analysts of repute, including Louis Vincent Gave and Eric Townsend, have postulated scenarios wherein Russia might contemplate constraining its energy exports. This theory gained traction when, on September 21st, Russia implemented a prohibition on the export of petroleum and diesel. Such measures, seemingly a counter to Western sanctions — which not only fell short of their objectives but also drew censure from figures like Hungarian President Viktor Orban — hint at the potential strategic use of the energy sector.

The sanctions levied against Russia are unparalleled in their intensity. Their initial impact was palpable on the Russian economy, triggering a surge in the value of the rubble. However, demonstrating resilience, Russia deftly navigated these economic waters, ensuring currency stability, fostering a burgeoning domestic sector, and identifying alternate trade routes. This adaptability challenged the notion of Russia’s dependence on Western entities, leading to whispers about the potential re-engagement of firms with the Russian market, exemplified by speculations about the Inditex group’s return under a new guise. While these shifts painted Russia in a resilient light, one mustn’t overlook the challenges inherent to navigating global isolation in today’s interconnected capitalist world. Indeed, 2023 has been less forgiving, with the combined weight of sanctions and war-related expenditures dragging down the ruble’s value against the Euro. Furthermore, the political turbulence, epitomized by the coup attempt led by Evgeniy Prigozin of the Wagner Group, his abrupt death, and the ensuing apprehension of Igor Girkin, the GRU chief, indicates escalating internal strains. Thus, the decision to halt oil exports may reflect a broader strategy of consolidating power.

Exerting dominance over energy assets is undoubtedly a bold move, and given Russia‘s prominent stature in the global oil marketplace, it can wield considerable influence over pricing. Such leverage might pave the way for potential negotiation overtures towards the Western bloc. However, this strategy is a double-edged sword. By restricting exports, Russia risks creating a vacuum that other nations might be keen to fill. The situation mirrors Russia’s past gambit with natural gas exports to Europe. In the aftermath of the Ukraine conflict’s inception, Russia sought to compel European nations to transact for Russian gas in rubles, a move that momentarily fortified the currency. Yet, the European Union’s savvy counter involved diversifying energy sources and maximizing gas storage, bolstering its strategic position. Therefore, while harnessing energy assets remains a powerful tool in Russia’s diplomatic arsenal, it’s crucial to recognize that the West has demonstrated the acumen to counteract such tactics adeptly.

The American Domestic Front: Inflation, Labor, and Politics

The U.S. domestic landscape is now more vulnerable to global energy price fluctuations than ever before. As energy integrates further into the core of economic and societal functions, its pricing has magnified implications on socio-economic and political dimensions. This heightened sensitivity underscores the intricate dynamics at play, highlighting the crucial intersection of international energy strategies and domestic consequences.

Firstly, the palpable ripples of inflation and the escalating cost of living have transcended mere statistical figures. They manifest concretely in the everyday lives of Americans, reshaping their purchasing powers and redefining household economics. This phenomenon isn’t merely a fleeting concern but, in many ways, is reflective of broader global economic trends and monetary policies. Central bank decisions, fiscal policies, and international trade dynamics, when amalgamated, have precipitated this inflationary surge.

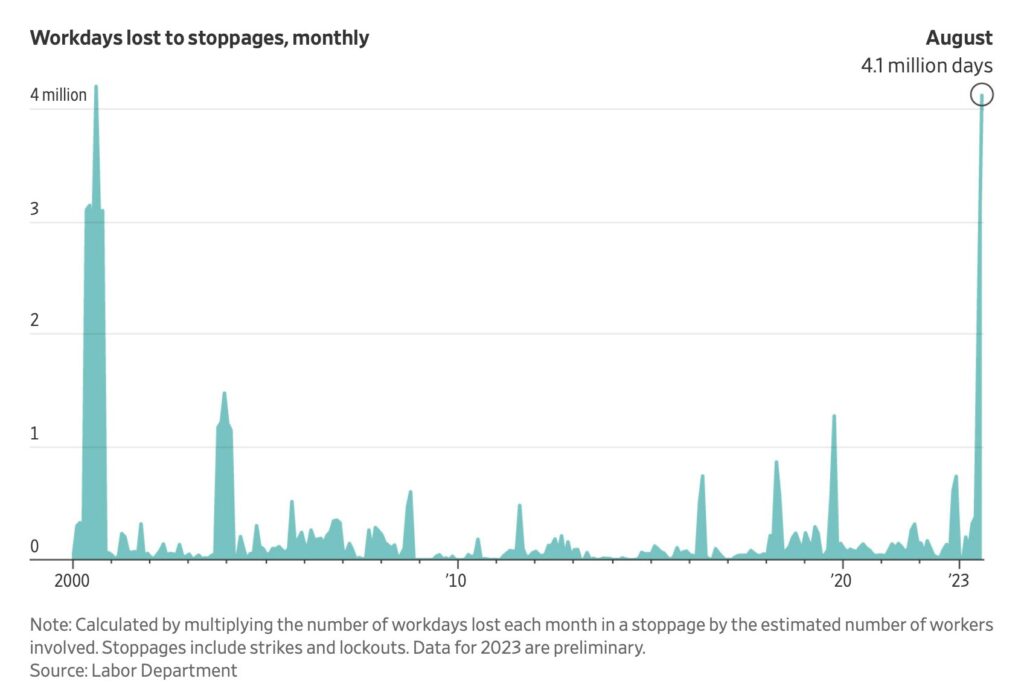

Parallel to these macroeconomic changes, there’s an evident socio-economic metamorphosis. Labor strikes and movements, long considered the barometers of worker sentiment, have gained momentum. The significant labour actions associated with giants like UPS and the UAW (United Auto Workers) aren’t isolated incidents. Instead, they signify a broader shift in the labour landscape, emblematic of workers’ quest for better wages, improved working conditions, and a voice in the increasingly automated and corporatized workspace.

Additionally, the U.S. government stands at a critical juncture in the current socio-economic landscape. As criticisms mount against its economic measures — from stimulus packages to taxation reforms — a discernible disconnect emerges between the intended policy outcomes and the public’s perception of their impact. This isn’t merely a contention over policy effectiveness; it delves deeper, questioning the very foundations upon which these policies are built. This tension is amplified by national polarization during election cycles, coinciding with Russia’s electoral timeline, making energy a potential ignition for deeper socio-political rifts.

Economic Signals: A Mixed Bag

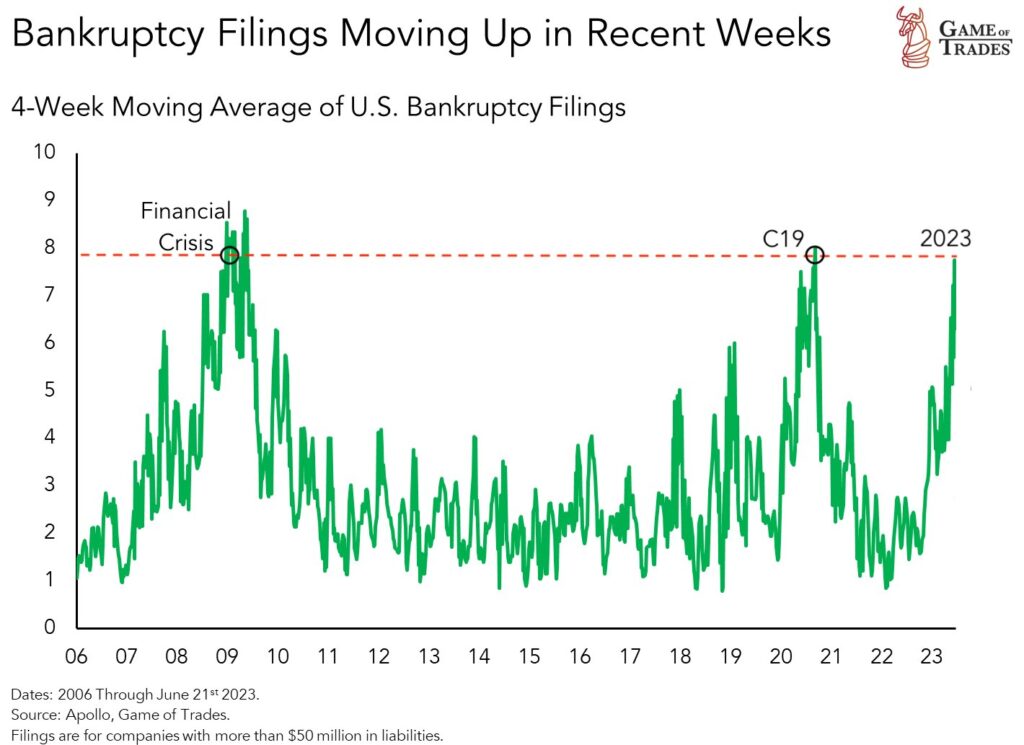

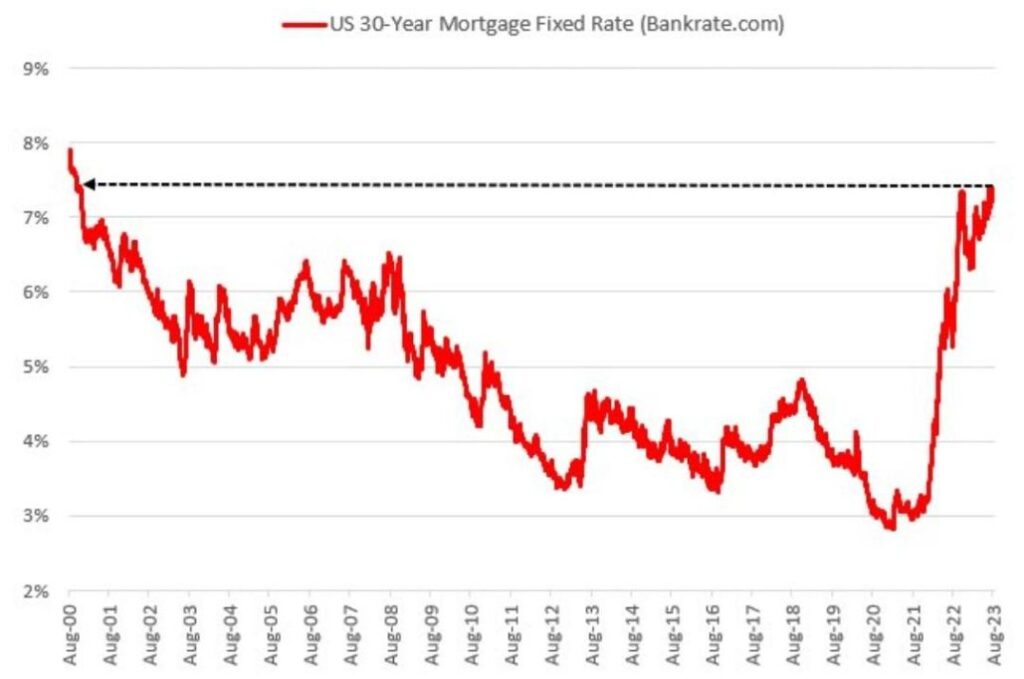

The prevailing economic ambiance indicates potential turbulence in the horizon. On one hand, the elevation in mortgage rates coupled with the pronounced escalation in U.S. bankruptcy statistics and emergent indications of a default cycle can potentially be precursors to an economic downturn.

The recent monetary policy adjustments by the Federal Reserve, especially the sequence of rate hikes, are just beginning to make ripples, and their aftershocks are yet to be fully felt in the macroeconomic realm. As these policies deeply entrench themselves within the financial fabric, the economy could be heading towards uncertain, perhaps even treacherous, terrains. It’s particularly alarming to note that mortgage rates, often a bellwether for economic stability, have not only climbed but skyrocketed to levels not witnessed in the past 23 years. This precipitous ascent in borrowing costs portends potential strains on household finances and could signal stormy economic conditions ahead as well as more internal inequality.

In juxtaposition to prevailing economic narratives, certain metrics suggest a trajectory toward resilience and potential bullish growth. The Bank of America’s Global Fund Manager Survey suggests a decline in recessionary concerns, marking a possible shift in macroeconomic sentiment. The current economy is a complex mosaic: while manufacturing faces headwinds, the employment sector shows bullish indicators. Central to this is the role of energy prices, a barometer for demand and supply dynamics. Their fluctuations can significantly shape the broader economic momentum. Such volatility in energy prices, if strategically manipulated, emerges as a potent tool in the geopolitical arena. From Russia’s perspective, wielding this tool effectively could compel concessions or even drive peace negotiations, leveraging economic interests to further diplomatic objectives.

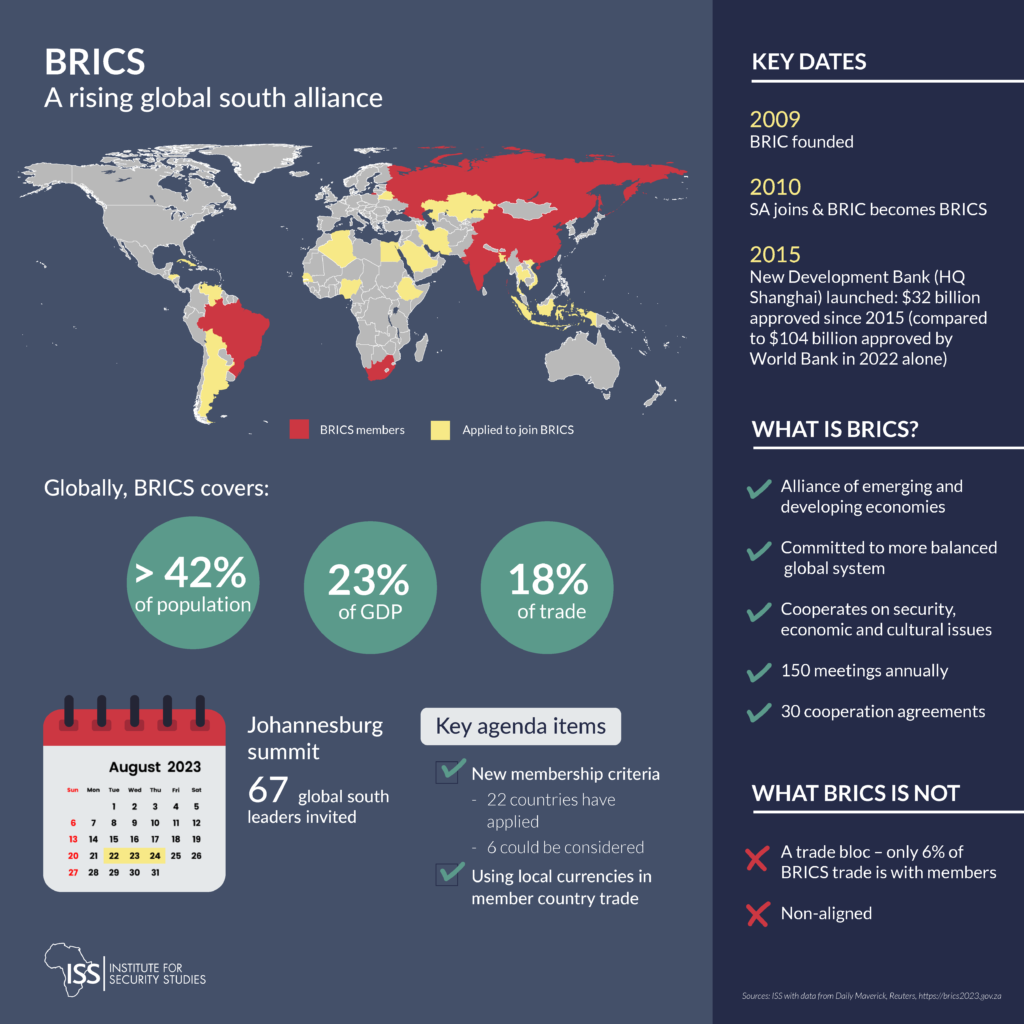

BRICS’ Influence on Global Oil Prices

Representing nearly half of the world’s oil production, the BRICS nations—Brazil, Russia, India, China, and South Africa—hold a formidable position in the global energy landscape. Particularly, Russia and China have been carving out amplified roles in global energy channels, suggesting a strategic alignment that could shift the balance of power.

While discussions on global energy dynamics often veer between extremes, insights from analysts like Louis Vincent Gave offer a nuanced perspective. Rather than pigeonholing the intentions of the East, Gave emphasizes the concerted potential of the BRICS bloc to shape energy markets.

More than mere production figures, it’s the BRICS’s strategic cohesion that poses a game-changer. Their collective sway over oil isn’t just about volume—it symbolizes their ability to recalibrate global energy discourse. As this bloc consolidates its influence, the prospect emerges of them potentially collaborating to exert pressure on Western economies through calibrated oil price adjustments, leveraging their united front to secure advantageous geopolitical outcomes.

$150 Per Barrel: A Plausible Peak, Yet Ephemeral in Nature

Drawing from the intricate analysis previously outlined, there’s a discernible likelihood of Russia deploying its energy strategy to potentially constrict its exports. Strategic actions such as “pipeline maintenance” or “port maintenance”, which would entail a significant reduction in daily oil exports, could send shockwaves through the global energy equilibrium. Such a move is not merely speculative but emerges as a viable trajectory, especially as energy strategy crystallizes as a pivotal fulcrum in the geopolitical arena. This scenario would likely propel the price of oil beyond the $150 threshold.

However, the economic framework suggests that such a dramatic surge in prices, even if realized, would be ephemeral. Even under the direst circumstances, an oil price of $150 per barrel would be unsustainable beyond a few days or perhaps a week at most. The economic equilibrium would be intrinsically self-correcting: even in the absence of compensatory oil production from other nations, the exorbitant prices would likely decimate demand, restoring a semblance of balance.

Consequently, while rare, such drastic fluctuations can recur and are inherently unstable. Short-term anomalies like April 2020, when crude oil prices plummeted to a negative $4.47 per barrel, further emphasizes our prediction. It underscores that oil-producing nations aim not merely for peak revenues, but for an optimal price that fosters profitability without severely undercutting demand.

Within the global energy landscape, Libya’s untapped hydrocarbon assets present a golden opportunity. With its rich reserves, Libya is uniquely poised to become an indispensable player, driving both regional and global economic growth. Beyond just energy, tapping into these assets could catalyze Libya’s national unity, turning historical divisions into collaborative strength.

As the energy sector undergoes transformation, Libya’s proactive engagement and strategic positioning can set a positive precedent, influencing energy narratives and fostering broader economic prosperity. Effective stewardship of these resources, complemented by informed diplomacy, can place Libya at the epicenter of positive energy shifts.

Championing Synergistic Growth

The Euro-Libyan Trade Center (ELTC), is a non-partisan, non-profit trade promotion agency working in cooperation with the GUCC to strengthen economic relations between Europe and Libya.

ELTC strategically positions itself as an enabler of transcontinental economic activities, offering a structured platform for entities with vested regional commercial interests. We are dedicated to enhancing operational capacities, broadening market access, and heightening the competitive index of enterprises within the region.

For tailored organisational strategy consultation, kindly reach us at +44 207 193 5556 or submit an inquiry via the provided contact form.

Follow us on:

- Twitter: https://twitter.com/eurolibyan

- LinkedIn: https://www.linkedin.com/company/eurolibyan

Latest News & Publications

Ready to Elevate Your Business?

At the forefront of our mandate to drive economic development, we are dedicated to fostering meaningful partnerships with regional stakeholders, businesses, and professionals across diverse industries, charting a course towards a brighter, shared future.

For inquiries, please complete the form below or reach out to us at +44 207 193 5556